30+ Front end debt to income ratio

What is an ideal debt-to-income ratio. Learn what a good DTI is how to calculate it and how to lower it.

Ex 99 2

The lender must document the additional debt s and reduced income in accordance with B3-6-01 General Information on Liabilities or B3-3 Income.

. The front end debt-to-income ratio is a calculation that takes the monthly gross income divided by the mortgage payment including taxes insurance mortgage insurance fee and any other. You can add 1125 to the income side and must add 1000 to the. To illustrate suppose you own a rental property with monthly expenses of 1000 and average rent of 1500.

Your debt-to-income ratio is fundamental to your home loan eligibility. The maximum amount allowed for an FHA Automated Approval on front end debt to income ratios for borrowers with credit scores higher than 620 FICO is 469 and the back. Save 50 or more monthly.

Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including. Learn more about DTI in this guide from Knock. Your debt-to-income ratio DTI measures your total income against any debt you have.

Your Credit Risk Level is Moderate Back-End Front-End Debt-to-Income Ratio. Ad Reduce Debt With Best BBB Accredited Debt Relief Programs. On the off chance that a homeowner.

The front-end debt-to-income DTI ratio is a variety of the DTI that computes the amount of an individuals gross income is going toward housing costs. Ad Weve rated the best options for getting out of debt. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

If your current front-end DTI is in the 40 or higher range you are likely headed for some significant financial difficulties and should immediately consider a plan to reduce your. Report looks at mortgage debt to income ratio. If your projected mortgage payment for all of this was 2000 and your monthly.

Front End Ratio Example. See offers from verified Better Business Bureau accredited partners. Your Debt-to-Income DTI Ratio is 2889.

Know Your Options with AARP Money Map. Ad Get Helpful Advice and Take Control of Your Debts. Free to Use for Ages 18 Only.

To calculate your front-end DTI also. A typical monthly mortgage includes the principal interest taxes and insurance and HOA dues. To determine your DTI ratio simply take your total debt figure and divide it by your.

What Is The Debt Payment To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Cmbs Disputes On The Horizon April 2021

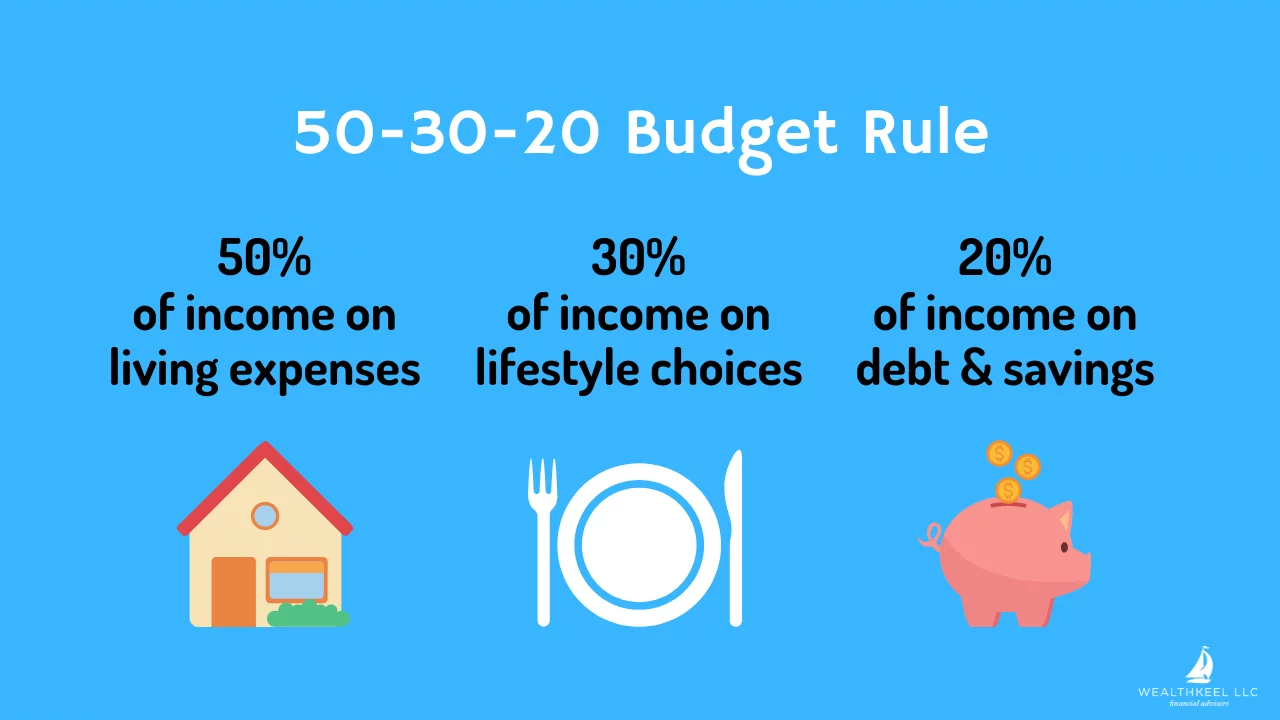

How Much Do I Need To Retire As A Physician Wealthkeel

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Filtering Oregon Office Of Economic Analysis

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

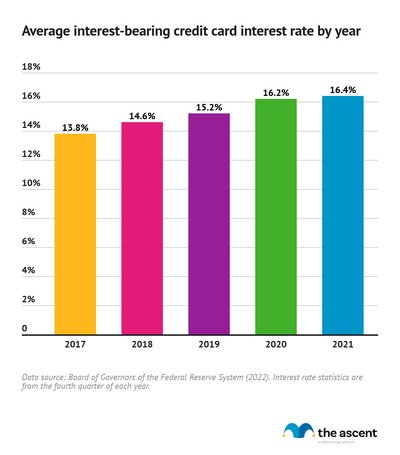

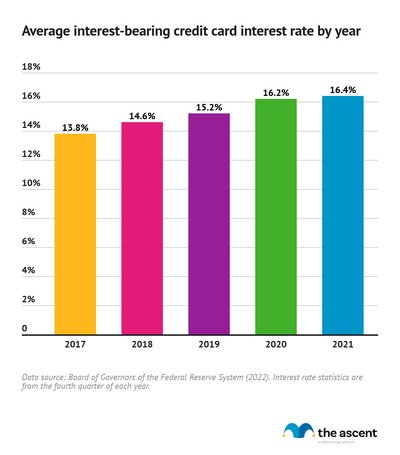

Credit Card Debt Statistics For 2022 The Ascent

Is Rent Included In Debt To Income Ratio Quora

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

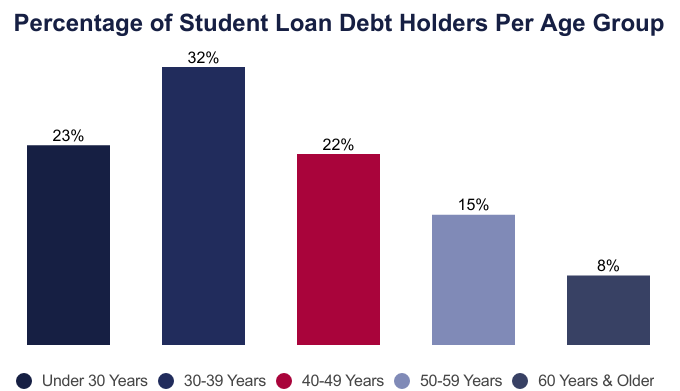

Average Student Loan Debt By Age 2022 Facts Statistics

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Deb Grace On Linkedin Housing Market Slows As Mortgage Rates Hit 6 25 Cnbc The Average Rate

Bank Debt Vs Bonds Types Of Debt Financing Securities

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street